- Less volatile since it is pegged to the US dollar.

- Transaction fees are lower than fiat currencies.

- Allows users to move funds quickly by leveraging the power of blockchain.

- Allows users to transact in US dollar fiat denomination anonymously without the involvement or payment of fees to third-party vendors or middlemen.

- Dai does not require a bank account for transactions.

- Can be safely stored in cold wallets with private keys.

- Anything one can do with fiat currency can be done with DAI.

- DAI is more secure than other stablecoins because it is backed by collateral assets at all times.

- DAI is more of a lending stablecoin rather than a payment currency.

- Faces strong competition from other stablecoins such as True USD (TUSD), Tether (USDT), and USD Coin (USDC).

📝Source Code – 🏠Website – 📈Chart 📱 Twitter

Dai Token (DAI) in a nutshell

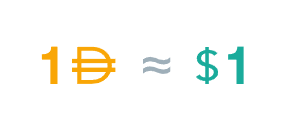

The Dai token (DAI) is a stablecoin and one of the most widely used cryptocurrencies since it is pegged to the US dollar at all times. The token can be used for payments where US dollar transactions are required. This token is one of the easiest crypto substitutes for fiat-based currencies.

The token has been widely adopted by the crypto-verse and is widely traded. Over 400 applications have integrated the DAI token enabling its use in everyday transactions.

DAI is primarily used to borrow loans by putting up collateral in the form of Ether or other cryptocurrencies. Thus, DAI is backed by the equivalent US dollar value of the collateral at the time of borrowing making it a premier stablecoin. The collateral assets can be liquidated in case the loan is not repaid and the issued DAI’s are burned once the loan is paid back keeping the value of DAI constant and almost equal to the value.

DAI has achieved a total market cap of over US$714.6 billion (February 2022).

Tokenomics

The current circulating supply of DAI is 10.11 billion and the stablecoin is issued to borrowers based on demand and burned when the loans are returned.

Has Dai Token been audited and doxxed?

Yes. The DAI token has been audited by the Callisto Network and is doxxed properly. Dai publishes regular documentation via press releases, and blogs and is active on social media channels. Dai claims that the value of their reserves is published daily and updated at least once per day.

Trust & Fairness: 4

Exchanges & Swaps: 5

Tokenomics: 4

Community: 5

Overall Rating: 4.5

Detailed Review of Dai Token (DAI)

The Dai token is under the governance of the Maker Dao protocol which issued another stablecoin known as SAI (Single Collateral DAI SCD or SAI). The DAI stablecoin runs on the Ethereum blockchain and was invented by a Danish founder, Rune Christensen. The previous version of DAI was known as SCD or SAI. It utilized single collateral in the form of Ether and was released in 2017. However, a later and current version allows multi-collateralized loans in more than one cryptocurrency. Any Ethereum-based token is today accepted as collateral by DAI subject to approval by Maker DAO’s governance board.

The advantage of DAI is its stability and this is why it is great for issuing loans or being used as a payment currency since its value will always correspond to a Dollar. Unlike other stablecoins, the DAI is backed by collateral assets of 150% and this is why DAI is considered more secure than other stablecoins.

Anybody can generate DAI by depositing collateral assets inside the Maker vaults governed by the Maker protocol. Once returned, the stablecoins are burned and this ensures that the DAI token experiences less volatility and is deflationary in nature. The DAI is governed by a decentralized Maker Protocol and is also backed by assets that are always 150% which is why it is considered secure.

The tokens are pegged with fiat currencies and the Maker protocol claims that each DAI token is pegged and is exchangeable with the US dollar in a 1:1 ratio at all times. The main advantage of using DAI in daily transactions is the unmatched liquidity on most exchanges and also the ability to transfer quickly and at a lower cost than other field currencies. It also provides the unique ability to avoid the volatility of traditional cryptocurrencies but is fully secure and can be saved on cold wallets.

Dai has been properly audited and all transactions can be viewed on the Ethereum blockchain since it’s an Ethereum token. It is one of the few stablecoins that ensures a lot of transparency for its users.

A large amount of lending operations in cryptocurrencies worldwide is carried out in DAI and it has become the preferred currency for people looking to borrow but avoid the volatility associated with other crypto tokens.

Another advantage of holding DAI tokens is that users can earn savings interest by depositing their DAI tokens into the DSR (DAI Savings Rate) contract in the Maker Protocol. The interest rate is decided by the Maker token holders. The organization is run in a truly democratic fashion with holders of the MKR token allowed to vote on various proposals regarding the DAI token’s governance.

DAI was used to provide assistance to disaster victims in a pilot project by Oxfam in Vanuatu.

DAI is also a great option as a payment currency in countries where the inflation rate is very high. DAI tokens were used for this purpose in Argentina.

Where to Buy Dai Tokens?

The DAI token is available on most exchanges. It is a popular cryptocurrency and you can buy DAI on some leading exchanges including Gate.io, LBank, BitMart, Binance, Coinbase, OKEx, Kraken, Huobi, Bybit, Poloniex, FTX, CoinDCX, Pocketbits, Whitebit, HitBTC, BitStamp, Woonetwork, TokoCrypto, WazirX, Bittrex, Bitbns, eToro, Crypto.Com, and HotBit.

You can buy DAI either through cash via P2P (peer-to-peer), credit or debit cards, or through other cryptocurrencies.

If you already hold some crypto, then you can use the coins to purchase DAI directly through a supported decentralized exchange known as Uniswap. All you need to do is connect your wallet such as Metamask and select the appropriate coin pair that you wish to use for purchasing DAI (for example BTC/DAI or ETH/DAI). The decentralized exchanges are a quicker and easier method that guarantees anonymity as you do not have to deposit fiat currencies or complete a KYC process before purchasing the Dai Token. You can also use DAI for purchasing other altcoins through the decentralized route as explained above.

What Can you do With the Dai Token?

Hodl as a long-term investor: You could simply hodl it and gain from its price appreciation in the long term. The token can also be used for deposits on supported wallets and exchanges to generate an interest yield. The DAI is pegged to the US dollar and though it goes through a slow rise, it will gain some value rise as the US dollar rises in value in the future.

Use DAI to pay for goods and services: The DAI cryptocurrency is supported by many payment carriers and can be used to pay directly for goods and services. It provides a quick and near-instant method for settling payments.

Swap DAI to other BSC/ETH tokens: You can use DAI and directly swap to other altcoins on a decentralized exchange. The process is quick and simple and is described below.

How to Swap DAI to other altcoins

Simply head over to a decentralized exchange and connect your wallet. Then, select the amount of DAI you wish to spend (factoring in transaction fees) and swap it for another crypto token. You will receive the tokens in the same wallet.

Earn Passive Income: DAI tokens can also be used to earn interest and it is a great way to generate passive income since DAI tokens are eligible to receive savings interest through the DSR route. Any user that deposits DAI tokens with the Maker protocol can earn DSR interest on their DAI holdings.

How to Buy DAI?

In order to buy DAI, you will need to use a centralized exchange or a decentralized exchange. Decentralized exchanges (DEXs) are simple and easy to use and do not require any registration. The process of token swap on DEXs has been explained above.

For purchasing DAI on a centralized exchange, you will need to register and create an account with the exchange and then deposit fiat currencies or crypto assets that can be used to buy DAI. You will need to complete the Know Your Customer (KYC) procedure to open an account on a centralized exchange.

Steps to open an account on a centralized exchange:

1. Go to the exchange site where DAI is listed and click on the Register button.

2. Then select your country of residence and proceed to the registration interface. Here, you will need to provide your email ID/phone number and a password that will be used to login into the newly created account.

3. Click on the agree to terms and conditions button and wait for the verification mail or message.

4. Clicking on the verification tab will take you to your new account. You will need to provide documentation such as a driving license, passport, or other government-issued IDs to confirm your identity and address. A utility bill and national ID may also be accepted in some cases. This process is known as the KYC regulation and it is in place to prevent the risk of fraud and to ensure that the site is safe for all users.

5. Once this additional step is completed, the exchange will activate your account and you can deposit funds to start trading. You can select fiat currencies or cryptocurrencies supported by the exchange to deposit funds to buy DAI.

6. Most exchanges support multiple payment methods including credit/debit cards, bank transfers, third-party payment processors, and P2P transfers.

Upcoming Events/Launches

Dai has revealed plans to become fully decentralized and will be one of the few projects to be run completely by the community. The Maker Foundation that oversaw some of the functions of the DAI project will be dissolved and all decisions will be taken by the community. For a stablecoin project, this is great news as no single organization can manipulate the DAI system for its benefit.

Token Price

Since the DAI token is pegged to the US dollar, it will always remain at the exact same price as the US dollar value. Although it has sometimes fallen below the value of a dollar and risen above it, the currency quickly rebalances to arrive at the same value as a US dollar. The DAI token has established its position as a leading cryptocurrency.

The DAI price can be checked on sites like CoinGecko and CoinMarketCap.

If you'd like to check some other stablecoin we suggest you to take a look our extensive guide on Tether.

DAI FAQ

Can DAI hit $10?

No, DAI is a stable token, which means that the price of the token stays flat.

Is DAI a scam?

DAI is one of the safest stablecoins that allows users to transact in US dollar fiat denomination anonymously without the involvement or payment of fees to third-party vendors or middlemen. Additionally, looking at the current daily trading volume of $474,779,557 indicates that DAI is not a scam and has the trust of many trustworthy entities.

Where can I buy DAI

You can buy DAI in multiple exchanges such as eToro and Crypto.com